The final countdown

Many of you will be adding the last touches to your VFM self-assessments if you haven’t done so. Some will be looking to have a second bite of the cherry by complementing what goes in the financial statements with a more detailed VFM statement or additional information (eg updated benchmarking data) for inclusion on their websites [1]. This article pulls together the HCA’s recent review of the VFM self-assessments [2] and Acuity’s coverage of getting the VFM self-assessment right at the summer club meetings.

We covered the HCA’s recent letter to larger associations and associated cost analyses in a previous blog .

How will I know?

What did we learn from the HCA’s review of the self-assessments submitted by the 1000+ stock associations in 2015? Not a lot was new information – more of a case of refining or clarifying what has been said before.

There is still some way to go in terms of associations transparently demonstrating VFM to external stakeholders [3] – remember this isn’t just a regulatory return, it’s about public accountability, which includes the ‘interested observer’, those in Westminster and Whitehall who remain unconvinced of the sector’s VFM and journalists with a questionable agenda . In terms of the last two, general ignorance as to what associations are and what they do is an excellent basis for misrepresenting the sector, hence the oft-made point that the self-assessment is an opportunity to enlighten, providing it does not stray into PR.

A transparent self-assessment should allow the external observer to reach an informed conclusion about where the association is doing well and where it could improve (and if it is getting better or worse). Transparency – primarily measured through the detail and comprehensiveness of the information provided it seems – has gradually improved over the years but it’s still variable.

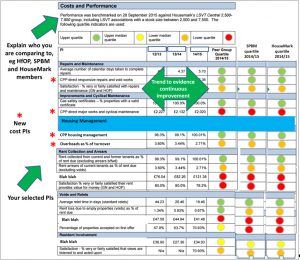

In terms of operational performance, transparency means offering ‘systematic’ evidence across activities, warts ‘n’ all, and not cherry picking what you are good at. It also means being clear who you are comparing against and providing trend data to understand direction of travel. At the July club meetings I provided this slide to illustrate what I think is wanted in terms of data – it’s an edited version of a ‘dashboard’ found in a VFM self-assessment .

Under pressure

Surprisingly, the HCA is of the view that self-assessments have actually become less transparent on absolute and comparative costs, which in part, explains the rationale behind ‘the letter’ and associated cost analysis: it’s a stimulus, helicoptered in, to ensure boards understand costs and cost drivers and are more transparent going forward. And I’m not just talking about the self-assessment – boards will be tested on this during the In-Depth Assessment (IDA). Some smaller associations might get an IDA if their risk profile warrants it.

HCA points out that failure to benchmark against past performance and peers in a transparent and challenging way is unlikely to provide sufficient assurance to boards or regulator that the VFM standard is being met. It notes that some providers did not provide up to date cost data and that comparisons were sometimes limited to an overly broad sector-wide peer group. This is why Acuity aims to get your annual benchmarking reports out to you ASAP and why we provide club comparisons alongside the SPBM (other small associations) and HouseMark (comparisons with wider sector) data sets. You can of course also run your own reports based on a bespoke peer group.

ROAd to nowhere?

Whilst return on assets remains a challenge to report, the sector is getting there – the HCA notes a steady improvement in providers’ accounts. This is about demonstrating your understanding of stock performance – do you understand the variation in performance across your stock? To answer this requires data of sufficient detail, eg by business stream, location, type or even property, and where contextual issues like demand and deprivation might be a factor. What can you do about addressing the poorer performance? –ie what are the key principles of your resultant asset management strategy? What kind of options were looked at (eg disposal, conversion, upgrade) and what is the rationale for settling on a course of action?

It’s also about demonstrating that you are acting on your strategy: how have your key asset decisions improved the value of the stock to the business over the past year or so? It’s not simply about financial return, it’s about value in a wider sense, in terms of achieving business objectives. You might justifiably tolerate poorer financial returns if they are essential to your mission. The HCA notes that some providers are complementing financial returns (eg NPV analysis) with an appreciation of the social, environmental and local economic returns to yield a more rounded measurement of asset VFM.

It’s also about playing in development: what did you build and how were any proceeds recycled into your mission? You are not being directed to make any government-ordained asset decisions, but HCA does want to be assured that the decisions you make are about maximising value to the business, in the context of mission.

Never gonna give you up

There remains a decided lack of ‘quantified targets for future savings’ (whether we should presume this also applies to quantified targets for performance gains is a moot point). The HCA wants this so that stakeholders can hold providers to account from one year to another on the achievement of their VFM ambitions – a check on the commitment to continuous improvement. Given that the rent cuts are now set to bite and business plans have been reworked following last year’s summer budget, the HCA is emphatic: associations need to stand and deliver- it is essential they identify how they intend to make on-going improvements in VFM, quantify them and communicate it transparently.

Past gains tend to be better reported with the best providing measurable outcomes (cost and performance), an account of how they were achieved and setting them against overall cost reductions as well as their fit with organisational objectives.

For those that might get an IDA, VFM is now a firm feature in the methodology – the VFM self-assessment together with HCA cost analyses provide the starting point for scoping the exploration – a reality check on your analysis and understanding of costs and your governance and performance management arrangements for driving VFM through the business.

What much of this points to goes beyond simple reporting of organisational VFM – it’s a demonstration that you have a grip on VFM – that data and other intelligence is driving business analysis, understanding and improvement action.

[1]Providing you furnish a direct link from the VFM self-assessment in your financial statements to any supplementary information on your website, the HCA will take the additional information into consideration in any evaluation of your approach to VFM. The supplementary information needs to be on your websites by 30th September.

[2] Delivering better value for money: review of value for money self-assessments

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/527806/Unit_Cost_analysis_-_VfM_self_assessments.pdf

[3] Julian Ashby notes in an Inside Housing article – http://www.insidehousing.co.uk/value-for-money/7015644.article – that increasing housing output whilst absorbing rent cuts probably offers the most compelling evidence of VFM, but this simple ratio could be knocked off course by environmental factors like a downturn in the housing market. So there is a need for a more effective evidence base that the sector is efficient. This is why the HCA is keen on the sector’s efforts in determining a voluntary suite of indicators that tell the world something about housing association VFM (Acuity, HouseMark and smaller associations are represented on the working group).

Comments are closed.